As a small business owner, the most frustrating thing about running the business is when we work really hard and sacrifice weekends and time with family just to end up realizing that our business is not growing in the manner in which we wanted it to grow.

I spoke to 14 small business owners to understand their journeys and views on what one should do when faced with a situation when their business isn’t growing as expected.

Each of them had a unique story, different circumstances where they struggled, but all of them had similar lessons and steps they took to turn around their own businesses.

When a small business is not growing, the primary goal of the small business owner is to ensure that there are enough funds for the next six months to take care of the business owner’s family after considering all liabilities.

There 10 steps suggested by small business owners I spoke to if your business is struggling to grow

Step 1: Secure your family’s finances

This is by far the most important step that echoed with all business owners. Ultimately, the business owner’s family needs to be protected irrespective of what happens to the business.

Most business owners vouched for creating a safety net for the family in case the business needs to file for bankruptcy later on. They strongly advocated being prepared with the following

- Taking out health insurance for all family members that is valid for at least the next 12 months

- Creating a savings and investment nest to take care of living expenses for the next 6 months

- Plan for major expenses for the year such as kids tuition, maintenance related expenses etc. in advance and set aside a corpus for that

- Consolidate all expenses bills so that these are readily available while filing tax returns which will give the best refund

Once done, this will provide a sense of assurance for the business owners family that even if the business were to suffer, the family is well provided for the next 6 to 12 months.

“A business owner will be able to take difficult but necessary decisions on the business once he has ensured the financial wellbeing and safety of his family even during tough times”

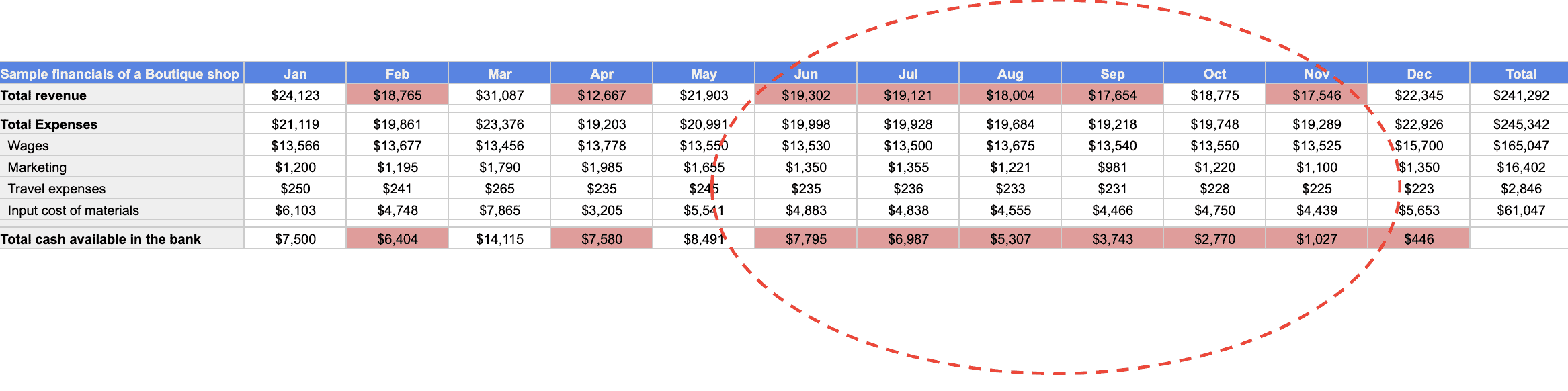

Step 2: Take a detailed look at your past numbers

This is the starting point of diagnosis to know for exactly how long you have been struggling. As a business owner, you will have to pull out the following data from your business.

- Month Wise revenue for your business for the last 12 months

- Month wise total expenses for your business for the last 12 months

- Split the total expenses into wages for employees

- List out month wise expenses for marketing

- List out your expenses for travel

- List out the costs of your input material

- Actual cash in the bank at the end of every month for 12 months

Once you have this information laid out in a simple spreadsheet, it will reveal where and when the problem began. You will be able to correlate the cause of your struggles and the time period so that you can re-assess some of the decisions you took.

Step 3: Retrace the decisions taken in the past 3 to 6 months

The numbers laid out in the previous step will reveal certain breakout points when you compare the past trends. Look out for any of those decisions impacting the growth of the business.

Some examples suggested by the business owners i spoke to are

- Look at the ratio of digital marketing spends to the revenue generated in the subsequent 3 months

- If the total spends to revenue generated is on an increasing trend for two quarters, your digital campaigns are not effective and you will have to relook at them or take a relook at the platforms you are spending money on

- Look at the amount of inventory you hold month over month

- Is the money spent on inventory as a percentage of revenue increasing month over month? If yes, then your business is not efficient in converting your inventory into sales fast enough. This can be a good place to start rethinking your inventory mix.

Similar to this, each business owner will have some specific set of ratios they can look at which is suitable for the business to evaluate where the drop in efficiency has been and take a corrective action.

Step 4: Audit each expense and the outcome they have on the business

This is a crucial step that helps the business owner identify how much each dollar spent is earning from the business.

One of the business owners who is really successful, running 8 businesses and grossing over $25 million in annual sales combined had the following to say

“The benchmark of a successful business expenditure is when a dollar spent is able to earn itself back in 3 years or less”

Everytime a business owner is struggling, they should look at the following

- The ratio of average revenue earned per employee to the average salary paid, this should increase by at least a 5% every quarter

- Dollars spent on marketing versus revenue from the same marketing channels, cut the channels where the costs are not recovered

- Dollars spent on traveling & networking to revenue from those efforts, cut down on efforts that don’t have any returns

- Money spent on beautification, aesthetics or anything that does not directly add value to the customer experience – Eliminate this unless you run a store that needs to be beautiful

- Money spent on software versus how much of the software is actually used to drive productivity – cancel subscriptions where you can manage using simple spreadsheets to do your work

As a business owner, when you critically examine these factors, you will be astonished by how much money gets leaked unknowingly which when plugged can save a drowning business.

Step 5: Relook at your ideal target customer profile

This is a fundamental decision that many small business owners will have to take if the business is not growing.

A friend who ran an online tutoring business shared an instance where he changed his ideal target customer and that led to a 10X growth of his business within the next 3 months.

He ran an online educational business that was targeting the 11th and 12th grades of high school in India.

This segment has a lot of organized competition in the form of ‘coaching centers’ that are specialized in offering on-premise classes and a special focus on test preparation for the multitude of examinations that students have to take to get admits into reputed engineering or medical colleges in India.

In the first six months, my friend tried a lot of marketing and networking to try and acquire customers for the paid program.

He ended up acquiring only 27% of the students that he needed to achieve profitable growth.

This prompted him to seriously relook at his target audience

He shifted his focus towards grade 6 to grade 8, which were the foundational years of high school but had a much lesser coverage of organized tutoring options.

Within 3 months, he acquired more students than what he had planned for in his best case scenario which put him in a position to capitalize and build an almost near monopoly in the space he targeted.

The pivot in target audience, required him to make changes to his curriculum, the style of delivery and the testing methods to make sure the target audience got value.

It was worth it in the end.

Step 6: Pivot to a business idea with better economics

Many small business owners will have experienced this.

Market forces, economics and competition will trigger changes when compared to the original business idea.

Sometimes, entire business models will have to change, forcing the small business owner to acquire new skills.

In order to pivot, there are some fundamental questions you need to ask, which will tell you if it makes sense to pivot the business or not

- Is the primary problem unit economics (paying more to get a customer, than what the customer pays) or growth? If it’s unit economics, then pivot.

- Are there too many small businesses in this sector where the failure rate is high (you can read my article here on why small businesses fail so often)? If yes, then definitely pivot

- Do you have the required skill sets to get your hands dirty in the most granular details? If not, then pivot to a niche where you have the skillset.

Examine the above 3 points to decide if you need to pivot your business, even if the answer to one of them means you need to pivot, then so be it.

Step 7: Reach out to friends and family

This sounds pretty obvious, but the deeper insight is something that not many people understand.

As a business owner who is struggling, what you need first and foremost is a set of customers who trust you and are willing to stay with you over the long term.

It’s these customers who will give you a steady stream of cash which you can reinvest back and grow your business from there.

Ask your friends and family to market the business for you, its free and it gives credibility because it’s by word of mouth.

Look specifically for a sponsor or a mentor who can open doors for you with potential large customers who will stay with you for the long term.

This is a specific area that many successful small business owners leverage and those who don’t, mostly end up struggling, which I have covered in detail here.

Step 8: Invest in long term organic methods

Many small business owners struggle with marketing, especially on online channels. Anecdotally, a lot of small businesses find success with paid ads, but the reality is far from this.

Paid digital marketing on platforms like facebook display ads, on instagram, on youtube costs a mini fortune for the small business and almost always has a negative return on investment.

The most sensible form of paid ads would be to do a localized, small geography specific sponsored keywords which can rank you in local searches on google.

Apart from that, every small business owner needs to have a plan for generating organic traffic to their digital presence.

You don’t need to spend money to do this.

You need to invest your time and create the right content for it to show up in organic search results in google.

This takes effort, its has a long gestation period, but after 18-24 months of continuous effort, it will give you a lifetime of organic free high intent traffic to your website that you can monetize.

Step 9: Ask for help

Many small business owners think its their personal failure if their business is about to fail.

It’s not.

If you look at my article on why small businesses fail, you can see that it takes a lot of effort and luck to succeed in a given sector and there are many small businesses that fail.

When you feel you are in that situation, PLEASE ASK FOR HELP.

There are several organizations that support small businesses with free resources and subsidized financing and advise from experts to help your business come back on the right track.

I am listing down some recommendations below that many will find useful.

Step 10: Sell the business

This may be something that small business owners may never want to do since their business is like their baby.

However, there comes a time, when the inevitable happens and the best way out would be to sell the business, either as a whole or a specific portion.

While considering a sell-off, look at the most valuable assets that you may have built, most of these would be in the following areas

- Your key customers, that can be handed off to a potential buyer who can provide the same if not better levels of service

- A unique and more efficient process that you may have developed, that can be trademarked and licensed for broader use by other larger businesses in the industry

- Special inventory that has a scarcity value associated with it, could be like limited editions or things that are difficult to acquire

- Specialized knowledge that your personal experience or expertise in a field which you may want to monetise by becoming an advisor to the entity who is willing to buy out the business

These are the four key areas the small business owners need to focus on selling so that they can get the maximum value for what they have built over time.