I have spent a considerable amount of time with the on-ground sales teams to understand the issues our customers faced. Our customers were small businesses, typically run by a single owner or a small team with less than 15 employees.

On one such occasion, I met a business owner who ran a business of setting up Audio, Video teleconferencing equipment at newly built office spaces. He was in the process of closing down his business and through the conversation I learnt the consequences of not driving meaningful growth.

Any business that does not grow revenues for 3 years in a row have a 90% chance of closing down by year 4 and a 100% chance of closing down by year 5. Rising input costs eat into the profits and cash reserves which lead to the decline.

The small business owner I spoke with gave me a few insights, that I believe will help all small business owners

Growth was not the primary focus, solving day to day issues took up all the time

He said that most of his time and effort was spent in ensuring the work entrusted to him and his team was done on time. This meant following up with his employees to show up on time, to get the project done under timelines and to help in troubleshooting and getting the equipment as it was meant to be.

A significant portion of time was also spent in maintaining the cashflows. This meant following up with contractors to get payments done, to manage the upfront payment for the equipment since he operated on an inventory model and to manage the fortnightly payments to his employees.

While running the business in this manner, naturally, each new customer would pose more hiccups for the business owner. The growth of the business and adding new customers took a back seat.

Very soon, the delayed collections from completed projects, the money stuck in unused inventory and the trouble in paying his employees without borrowing made it very difficult to generate additional revenue.

He decided to close the business down and liquidate his inventory.

Why does a business that does not grow end up failing?

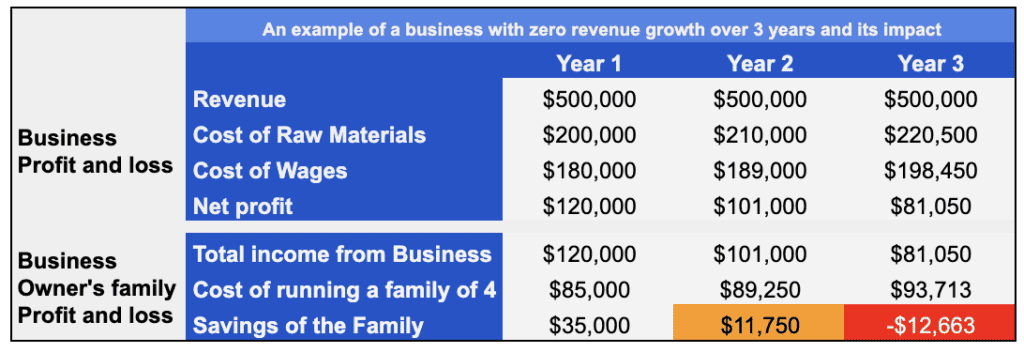

To get to the answer, we need to look at an example provided here. The company in question has been able to maintain constant revenues of $500K every year for the past 3 years. Take a look at what happens to the input cost its effect on the profits of the company.

As you can see, right in the second year of operations, the profit that is available for the business owner and the family drops dramatically and by the third year, the profits are not enough to cover the running expenses of the family.

Most business owners dont appreciate the impact that inflation and rising inputs costs have on their on standard of living.

I have not added the problems that additional debt causes to the finances of the business and consequentially to the family. The situation would become dire if interest payments are added to the profit and loss statement of the business.

Lack of business growth will eventually drive the business owner to shut down the company and to recoup some of the losses. This is the main reason that more than 80% of small businesses that start up in the US, do not go beyond the 5th year of existence.

How to diagnose what causes a business to stop growing?

There are 5 specific areas that a business owner should deep dive into to diagnose if a business is not growing, ask yourself these five questions.

- Are you always behind on collections from customers?

- Do you have the necessity to borrow from a bank to make payments to your suppliers or your employee salaries?

- Do you face a high attrition rate of employees?

- Are your customers generally unhappy?

- Do you see yourself compromising on your margins to get a sale?

If you have answered yes to at least 3 of the above five questions, signs are that your business is heading down the path where it may not be able to grow consistently.

These five questions are at heart of some of the strategic decisions that you have made while starting your business.

Chasing customers for payments?

The most important cause for this is the selection of target audience. As a small business owners, you will do well to serve customers who can pay you an advance or at the time of delivery of your product or service. Think of the motto “Get paid before you pay”.

Need to borrow to pay your suppliers?

This is an indication of how quickly you are able to turnaround your inventory into sales. The faster you are able to convert your inventory into sales, the more cash you generate using which you can make payments further.

Do you face high attrition?

High attrition is when an average employee leaves within 3 months of coming onboard.

This is an indication of two issues

(i) The employees do not believe in the business model of your business as they know that it cannot grow

OR

(ii) You don’t treat them well enough to stay for longer. Dig deeper and get feedback to course correct.

Are your customers unhappy?

This is an indication of two possible issues

(i) You don’t have the expertise to solve the problem for your customers

OR

(ii) You are solving the wrong problem for your customer.

Most cases it’s the latter and the key contributing factor is that you have not understood what is the customer’s real problem for which they come to you. You need to get into the customer’s shoes to understand this much better.

Do you end up compromising on your margins to get a sale done?

When a business owner ends up cutting his own margins to get a sale, it means that the only real factor which the business can compete on is price. This indicates that the business does not really have a competitive advantage in the industry.

As a business owner, you need to have a distinct advantage over the other businesses who offer the same product or service due to which customers will come to you even if the prices for comparable products are marked up by 10%.

The only way you can do this is to truly get into the shoes of your customer and figure our their genuine problems that you can solve using your expertise.

Not knowing the exact problem of the customer that you are solving for is the root cause of most symptoms we see in many businesses that close down.

Of the five questions you will ask yourself, three of them are related to identifying your target customer really well and ensuring that you have enough such customers whom you can target to make your business sustainable.