I caught up with my friend last week, who has been running a boutique small business for the last 5 years and she told me how her small business is finally generating a steady stream of income for the last couple of years and that she is content and life is much better than when she first started. This prompted a discussion if she really should be content as a small business owner by just generating a steady stream of revenue or if she should look for more growth.

As a general rule, small businesses should grow their revenues by at least 10% every year because a gross inflation of 5% and energy inflation over 10% will decrease business profits and will increase costs for the business owner’s family along with a drop in standard of living.

Small businesses should grow at 15% to safeguard against any drop in the standard of living of their employees and they should grow above 25% to be able to expand their small business over time.

As a whole, the many reasons a small business owner should look at growing their business are as below

So in my friend’s case, is she right to relax right now that her small business is doing ok for now? Not really, these are things that small business owners should keep asking themselves as and when their small business starts generating steady revenue.

Why should a small business grow revenue every year?

All of us know over the last 12 to 18 months, world over, macroeconomic and geo-political events have pushed up the prices of all basic necessities and this in turn prompted a massive wage increase, an increase in cost of utilities, increase in costs of energy and a general increase in costs across the board. A small business that cannot handle these increases in costs over a long period of time will find it difficult to continue to operate.

In the US alone, in 2022-23, 9 out of 10 small businesses felt the pinch of increase in prices and 1 in 2 small businesses closed down since their revenues couldn’t keep up with the pace of increase in costs.

If the inflation is higher than the growth of your small business, you will have less to take home for your family. The same inflation will impact your family as well and you will see a drop in the standard of living for your family. This will compound much quicker than one can anticipate.

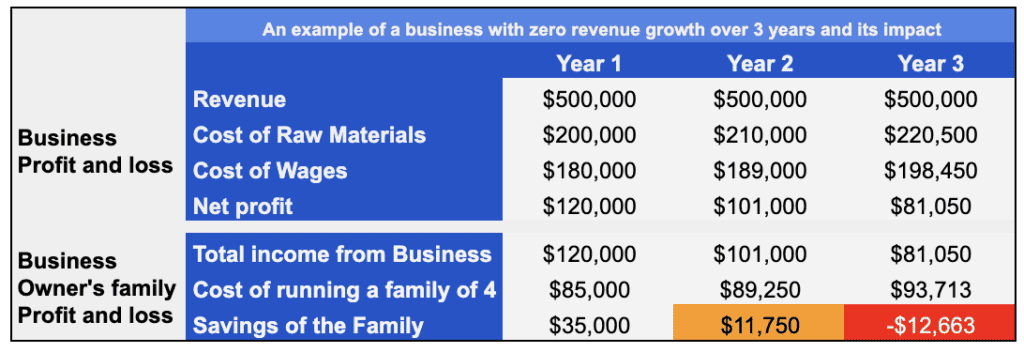

I have modelled the below 3 scenarios based on the information I have about a small business that deals in overhauling and repairing machinery. They have 4 employees and work on job contracts from manufacturers.

If the small business does not grow revenue every year and if the revenue remains stagnant, the scenario shown in the below table will take place. By the 3rd year, the business family will be impacted by a decline in personal savings as the business will not generate sufficient profits to keep the same standard of living for the business owner’s family.

A small business owner’s best hedge against this increase in prices is to focus on driving incrementally higher revenue for the small business every year. If the small business owner is capable of maintaining a revenue growth slightly over inflation, they would be able to comfortably maintain the status quo of their small business and manage an increase in all their input costs.

I would strongly urge small business owners to keep this growth rate at 10% year on year so that there is a margin of safety which can take into account most eventualities and the small business can still operate.

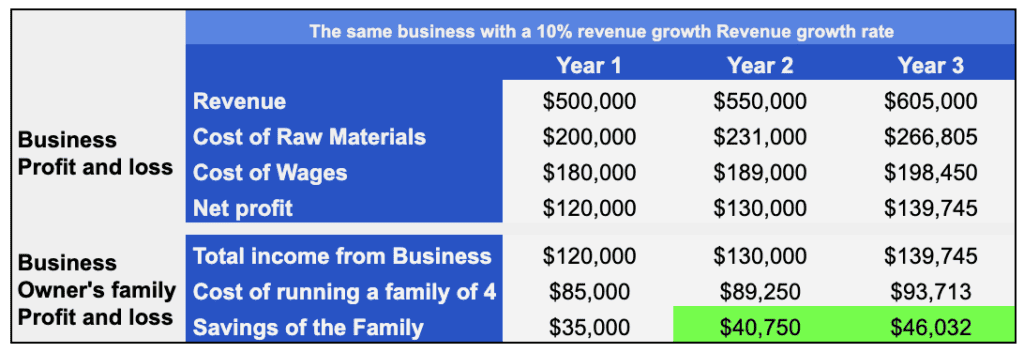

What happens if a business grows by 10% year over year?

Revenue growth will help cover your business costs and the costs of providing for your family and that of your employees

You are not just running your small business, you have a family to care for that is dependent on your small business. Just as how inflation affects the input costs in your business, it has the same effect on your family’s finances.

As you have seen in the table above, if inflation rate is at 5% at an average and if a business grows at a 10% rate year over year, for a moderate size of a business, the family will be comfortably placed even after 3 years with the annual savings showing a marginal increase year over year.

As a small business owner, it’s your responsibility to make sure that you plan in advance and set the right goals to grow your small business so that you can maintain and improve your standard of living.

Is a 25% revenue growth rate a good growth rate?

As you saw above, a business growing at 10% can help the business owner maintain the standard of living and have a gradual increase in savings. If the business grows at 25% year over year, the situation dramatically changes and sets the stage to begin a virtuous cycle.

The business owner will have excess cash at hand that he or she can reinvest back into the business. This investment will have to be related to expanding on services offered, new tools and technology or an organic manner of acquiring more customers over time. This ability to reinvest back into the business will feed a virtuous cycle of growth that can enable the business to exponentially grow over time.

Most of the businesses that have become big after starting out small, have followed the time tested classic business growth playbook of reinvesting excess profits back into the business to grow it further and to build and strengthen capabilities.

A 25% year on year growth rate maintained consistently, is a sure shot way of ensuring that the business is primed for growth into the future and has a much higher probability of becoming a large business when compared to businesses that grow at a slower rate. Businesses that grow at 25% year over year also have the lowest probability of failure.

Revenue growth will enable small businesses adopt technology and improve productivity

Once you have a growing small business, will you be in a position to adopt newer technologies that will help improve the productivity of your team and that of your business.

If you want to deploy an enterprise resource planning (ERP) software for your small business to keep track of inventory, sales, purchases, accounts payables, receivables etc. the investment in software is going to cost you an upfront cost as well as a recurring annual fee which can cost anywhere between 1% to 5% of your overall revenue depending on features and number of licenses you chose to have.

Your small business will be able to justify this cost only if it grows revenues over a period of time and has the cash flow to fund this additional expense. The successful deployment of such technology is often the differentiator between an efficient small business that can grow sustainably versus those that fall by the wayside after a few years of operations.

My friend who runs an event management company and generates >$1 million dollars in annual revenues and has 8 employees swears by the new SaaS based CRM tool he has adopted.

According to him, managing and tracking the sales funnel through the CRM has helped him grow his business by over 15% every year for the past 3 years by enabling him not to lose out on potential leads due to lack of follow up or meeting them at their time of need.

Using this tool has also enabled him to keep a sharper focus on his sales teams and execution teams on how they acquire and service their accounts and the repeat revenue they have been able to drive.

Revenue growth is critical to drive economies of scale for small businesses

If a small business grows revenues over time, usually that is driven by acquiring more customers or increasing the revenue per customer or a combination of the two. It is also often accompanied by consuming more resources that go in as inputs.

As a small business tends to consume more resources every year, the ability of the small business owner to get better deals with the suppliers improves and the unit cost of each resource will go down. This will have a positive impact on the costs of the small business which will help it in the fight against inflation and also help it become more efficient which will help in feeding the virtuous small business growth cycle.

As the small business grows, the dependency on a small group of customers would diminish which will help the business improve its pricing power in the market. If a small business serves a progressively growing number of customers every year, the bargaining power of each individual customer decreases over time and this helps the small business in maintaining or even improving its overall margins.

Revenue growth will help small small businesses improve cash flow

All small business owners who have boot-strapped their small business know very well that cash is king. When it gets real about the performance of our small business, the only metric that matters is the cash that the small business generates and if that is sufficient or not.

The sure fire way to ensure that a small small business can generate cash is to ensure that the small business grows its revenues consistently. Only growing revenues over time can ensure that the small business generates cash to sustain its operations and only an improvement in cash flow will ensure that the small business can survive over time.

Revenue growth every year is an indication of the small business winning in its market

Every small business has a target market that it serves, an identified set of customers whose problems the small business is solving for. If the business is able to grow revenues each year, its an indication that the business is able to penetrate its target market and help solve problems for more of its customers.

This is the first sign that the small business has a sustainable business model and the business owner should then get restless to see what can be done to make it even better for customers.

This growth also signifies to the competition that there is an economic opportunity that is up for the taking and is an open invitation for multiple similar businesses to set up shop to attack the same market. Small business owners should keep their eyes and ears wide open to such signals and take immediate action to protect their engine. When a small business owner sees the drop or stagnation in revenues, this should send alarms ringing that a comprehensive business review is due.

Which is more important between Revenue growth and Profit?

Another business owner who I got in touch with, runs a boutique store that she started a couple of years ago and told me that she has been super focused on maintaining and growing her profits rather than her business revenue.

She is a sole proprietor and makes about $250K per annum from her business. About 60% of her revenue goes to cover her input material costs and another 15% of her revenues go towards covering her overheads.

She retains a 25% profit margin with which she funds her own lifestyle. She says that she goes through the costs carefully for every project she takes up and executes. She only accepts projects where she can make a minimum 25% after the work is completed.

It’s better to put some rules and standards in place so that costs and overheads are guided by those rules so that profit margin is predictable and does not need to be evaluated for each and every project.

These rules could be standardising the suppliers for raw materials with a guaranteed minimum order every month so that costs are stable, it could be optimising overhead costs so that they don’t vary with every project.

Once standardised, the profit margin can become predictable and then the business owner can then focus on acquiring more customers, hiring more folks for help to drive topline revenue.

Once the business starts growing revenue after controlling costs, the constant profit margin will continue to grow along the same rate as revenue growth.

It is important for business owners to fix their costs using standard rules and then have their focus purely on growing revenues thereafter to start the virtuous cycle. If there is no revenue growth, there is an upper limit on how much profit the business can generate and even profits will tend to stagnate.

Are there any exceptions to the rule?

There are some situations where a small business owner may choose to deliberately not grow his or her business. I have discussed this in greater detail in the article here.