Small businesses contribute to more than 99% of registered businesses in the US and more than 45% of the GDP. Small businesses also have the highest rate of failure with more than 80% not surviving beyond 5 years.

The path to rescuing a struggling business may not be linear, and it might require a combination of many strategies. The key is staying resilient, adaptable, and willing to learn from past mistakes. With dedication and the right approach, small businesses can recover from the brink of failure and emerge stronger than ever.

The following section goes into multiple strategies that small businesses should adopt.

The first step for the small business is to address the downward trend of the business. These strategies will help the small business to do so. There is a related article here on why small businesses often struggle.

The following strategies give a step-by-step plan to help a small business evaluate and save it from failure.

Conserve financial resources as top priority

When the business discovers that he is losing money and the business is not growing as it is expected, the first priority should be to conserve financial resources. Here is a ready list of areas that the small business owner can look at to cut expenses on priority

- Unused Subscriptions and Memberships – Cancel everything that you don’t use or use very rarely

- Utilities and Energy Costs – give up on what is not essential to running your business

- Office Space – Vacate the big office, work from home, if you own the office space – rent it out

- Travel Expenses – Avoid travel that does not have immediate RoI

- Marketing Costs – Get really sharp on the RoI on each activity

- Printing and Paper Usage – Pivot to digital means

- Employee Benefits – Reduce freebies, incentivise behaviour that results in business growth

- Outsource and use freelancers for non-core jobs

- Technology and Software – Consolidate various tools that you use

- Inventory Management – Do a fire sale of inventory that has not sold to release free cash

- Training and Development – Look at only essential roles

- Banking Fees – Negotiate, explore different banking partners with lower fee structures

- Insurance Premiums – Negotiate hard, look for newer providers

- Telecommunications – Pick cheaper plans for internet and phone services

- Legal and Professional Fees – Negotiate rates, get out of retainer agreements

Re-evaluate your business plan

After you have cut down all unnecessary expenses, you should take a long and hard look at your business plan. The key areas you should cover are listed below along with what to look for in each

- Analyse your identified market – Have customer preferences changed?

- Analyse your competition – Are there other businesses targeting your customers?

- Do a thorough SWOT analysis

- List down all external and internal factors that have changed since you started your business

- Look at your financial performance as a monthly trend

- Have you grown revenues consistently? (Here is why you should)

- Has your gross margins decreased?

- Are you making the same level of profit

- Go deep into customer feedback – Are you missing something that customers want?

- Look at operational efficiency metrics that you use to measure growth

- Look at all the new risks that have come up

Check if your business model is working

Business model refers to the assumptions that you make for the business to make you money. It is how your business plan translates into action.

Simply put, it is the set of things that should go right, for your small business to generate money according to plan. If your business model does not work, it’s best to go back to the beginning and start fresh.

Once you have re-evaluated your business plan, here are a list of things you must look at to confirm if your business model is working

- Is revenue being generated from the sources your planned?

- Is revenue being generated as fast as you planned?

- Have you been able to acquire the kind of customers you wanted to?

- Did you acquire as many customers as you planned?

- Are you retaining your acquired customers like you planned?

- Thoroughly examine your cost structure – Are you spending more than you earn?

Once you have answers to these questions, compare them to where you started and evaluate the changes that you need to make.

Ready a business turn-around plan

Once you have taken stock of your current situation, readied your finances; now you have to make a plan to bring your business out of the struggle and back on track to growth. Some of steps you need to do here are more mentally taxing than physical. Lets take a look.

- Mentally get ready for a few difficult months ahead

- This is the hardest part – make your family understand your situation

- Keep stakeholders, customers and regulatory offices informed about the business situation – buy more time if needed

- Consider taking on a long term loan after speaking to your financial advisor

- Speak to your employees – be transparent and honest about the problems facing the business

Once you have done the above, you now have to focus on the next steps to come back to the growth path.

The following section looks at the strategies that small businesses need to get back to growth after failing

These strategies will help a small business bounce back to growth after they taken remedial measures once their business has experienced failure.

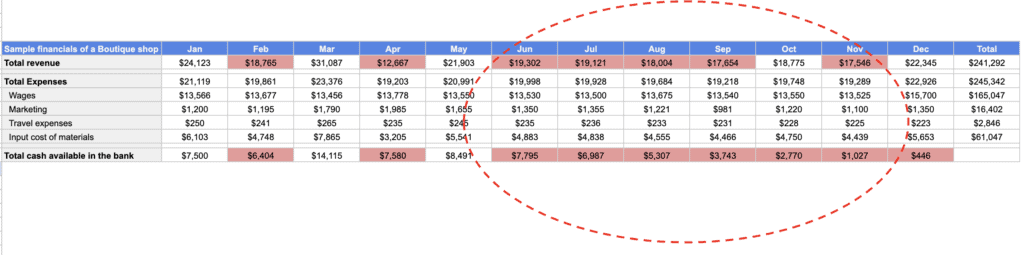

Ensure positive cashflow as the top priority

Positive cashflow is when your cash inflow is greater than your cash outflow. There are many best practices that small businesses can adopt to ensure that they always maintain a positive cashflow.

- Rewrite all invoicing, expense and credit policies for your business

- Define payment terms for your product or services – Getting paid first is always better

- Define credit terms for your suppliers – don’t give more credit than what you get from customers

- Tighten expense policies for your employees – negotiate better with vendors for preferable rates

- Plan your cashflows for the next three months in advance and set up a tracking mechanism

- Work with your accountant to do this for you

- Re negotiate contracts with your customers for payment terms

- Try to get paid as quickly as possible – large businesses use credit from small suppliers as their own working capital

- Make use of technology platforms to get paid quickly

- Try to make use of invoice discounting solutions if you are unable to negotiate payment terms

Identify the right customer for your small business

Getting the correct customer profile can make or break a small business. Many small business owners do not have a right target customer in mind. This crucial in many aspects but the most critical reason for doing this right is that the right customer profile will direct the resource allocation for the business.

There is a systematic process that can be followed to achieve this, its based on the brilliant D4D process that I learnt at Intuit which is known for building products to solve customer pain points.

- Look at the existing customers who did well for the small business

- Look for all common factors such as demographics, age, location, income level if they are individual customers

- If they are B2B customers, look at the industries they are present in, the kind of services they offer and the prices they charge their customers to understand their margin profile

- Break this customer profile into further segments to refine further

- Look at the segment of customer which is most profitable

- Is this segment large enough for your to capture and sustain your business?

- Look at all the common pain points that these customers face

- Prioritise the pain points that your small business can solve

- Compare the pain point and your offering to check if your solution solves all the customer’s pain points completely

- If yes, you have your target customer profile

- If not, evaluate if you can develop solutions to solve the pain points

- If you cannot develop solutions, then look for the next best pain point you can solve for

- Repeat the same steps till you are 100% sure of your solution to a problem

Any small business who follows this systematic process is guaranteed to achieve success with their target customers and do well in their business.

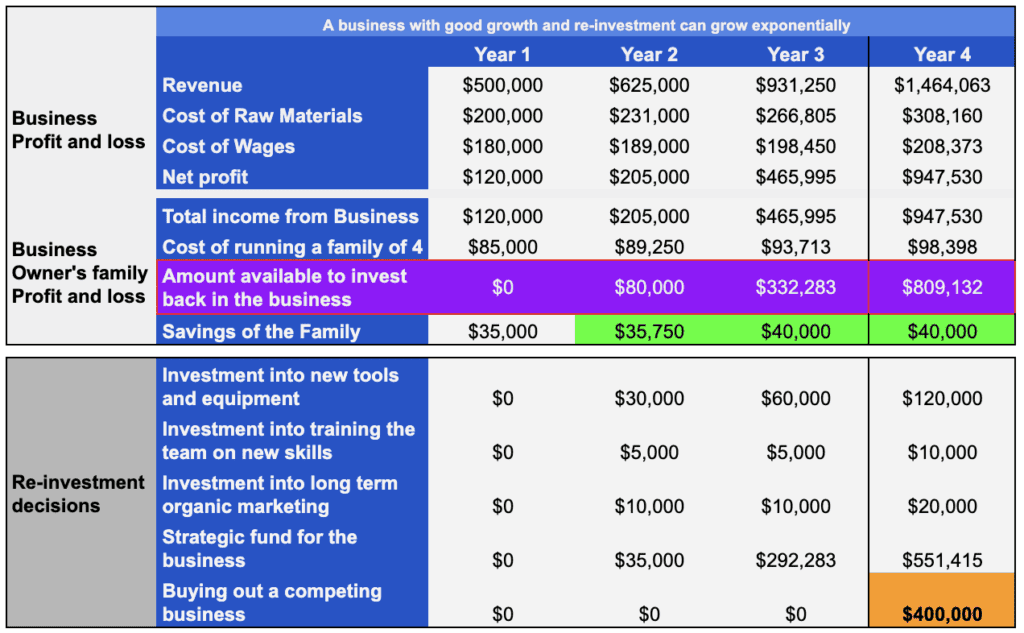

Prepare a reinvestment plan for your business

There is a very strong correlation between accelerated business growth and a small business reinvesting profits back into the business. In my article here, you can see clear data on how businesses that reinvest profits have a faster growth rate.

Some of the points to consider while deciding where to reinvest your profits are below

- How much spare cash will you need to take care of emergencies?

- Does the project you are investing in directly improve your product or service?

- Will this reinvestment help build a better customer experience?

- Has this reinvestment have potential to help you increase the price of your product?

- Will this reinvestment help increase the gap between you and your competitors?

- Will the reinvestment make your employees more productive?

- Will this reinvestment eventually give your business more free cash?

Once you have a satisfactory answer to all of the above questions, you should be in a position to come back to the growth path shortly.

Prioritise the most impactful decisions and actions

This is a secret weapon that differentiates those who are successful and those who are not. You have limited resources and limited mental bandwidth to make great decisions. Channelise the limited resources on the most important and impactful decisions.

Some questions that you can ask yourself to prioritise key decisions are

- Create a matrix of tasks that compares the outcome of each task vs the time and resources it consumes

- Actions that consume a lot of resources but also have a very high outcome will be the first set of actions that the small business owner needs to focus on

- Actions that have lower requirement of resources but have a significant outcome can be delegated within the team

- Actions that have a low outcome and need less amount of resources can be outsourced to a freelancer or an agency

- Anything that demands a lot of resources but does not deliver high degree of outcomes should not be pursued

Have a regular review mechanism to review progress

Once you have decided on your business priorities for your small business, its time to review the key metrics in a periodic manner. You can refer to my article here for a detailed review of how you can measure success of your small business.

The following points are key for business owners to track during the reviews to ensure that business performance is always on track

- Ensure that the collection of data is accurate

- Identify all the KPIs that are relevant for the business – This article should help

- Look at trending data for the past months and quarters

- Look at key interventions that should be taken as a business

- Identify action items and owners where business performance is not meeting expectations

- Identify timelines, owners and resources needed to take these actions

- Review progress and completion of these action items in subsequent review meetings.

Once you set up the rigour to measure performance of the business in a systematic manner, this will act as an early warning system to highlight what is going wrong in your business.